I started my first full-time job just over 6 years ago, at the end of my university studies. I was living in a low-cost student flat and had money to spare.

In a normal macroeconomic situation, having money stashed in a bank account is a bad idea. Inflation would reduce the purchasing power of cash by about 2% per year.

This is where the thinking process about the best use for money started. Should you pay off your student loan? Or invest? Would my savings be enough to buy my own home? What if interest rates rise? Are your spending habits sustainable?

The situation is particularly interesting now when the economy is going through its most eventful period in 15 years.

The purpose of this text is to offer some ideas on managing one’s wealth for those who have the opportunity to plan their spending. I am not trying to claim that such financial management is possible, easy or sensible for everyone.

I will present the wealth management application, a data-driven process and a set of ideas that I have honed over the years.

The starting point affects the possibility to accumulate wealth

These days, you can read about the successful stock portfolios of 20-year-olds in the newspapers all the time. It’s easy to conclude from these stories that you don’t get to those heights by mowing the lawn.

In addition to money, you may have had access to networks, advice or security from your close ones. In any case, the starting point makes significant impact on the chances of accumulating wealth.

At this point, it’s my turn to tell you how I once moved to a foreign city with only 5 euros in my worn jeans pocket…

Nope. My own starting point has been good all things considered, without going into any more detail on the subject.

At the end of my studies, before really starting the career, my total assets amounted to 3 500 euros. When you take into account the tens of thousands in student grants and university education, you can only thank society and your parents.

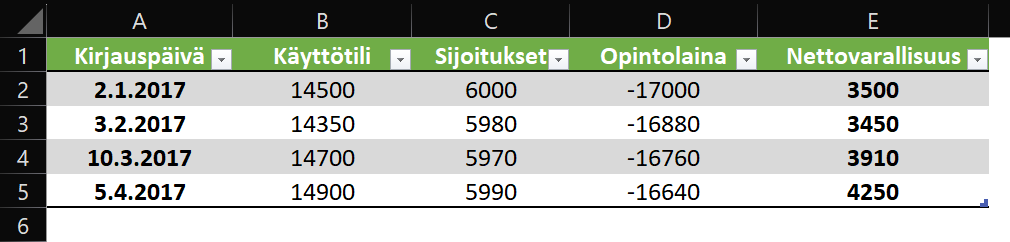

My wealth consisted of the following components:

| Asset type | Assets |

|---|---|

| Funds | + 6 000 € |

| Cash | + 14 500 € |

| Student loan | -17 000 € |

| Total assets | + 3 500 € |

Total wealth means all assets minus loans and debts. The term net worth is also often used.

A total wealth of 3 500 € is the equivalent of living in a rented house without loans and owning a 1997 Toyota Hiace.

The golden rule of seeking wealth: Invest everything you don’t need to live

My own financial planning principles are very simple:

- Don’t buy anything unnecessary

- Invest your extra money in diverse assets

The first one is not even a wealth management rule for me, but a life lesson. During my exchange study in Hong Kong 4 months with all my stuff in one backpack, I realized that the correlation between the amount of goods and happiness could be negative.

In my personal opinion, investments to relationships and hobbies are important. A massage chair and a rice cooker are not.

The most important measures of personal finance are cash and total wealth.

A prosperity seeker should aim to increase total wealth with cash as the main tool.

My own investment strategy is not very complicated. It is mainly based on low-cost exchange traded funds. I have bought individual shares mainly out of curiosity.

My only investment doctrines are diversification, waiting and constant risk assessment. These won’t make you really rich, but they are a reasonably safe way to grow your wealth.

Cash planning for wealth accumulation

Cash management plays an important role in wealth accumulation.

As you could deduce from my example, during my student years, student loans served as a financial stabilizer. Even though my net worth went into negative territory at times, I still had money in my account. Early in my career, student loans were a safety net for uncertainties of job and housing.

Keeping cash in a bank account instead of investments, on average, eats the purchasing power. On the other hand, over-investing drains cash and increases risk. It is therefore advisable to have just enough cash in the account.

More efficient use of cash allows you to grow your wealth without increasing the amount of money.

Planning the use of money over time is also important. So if you pay for a kitchen renovation this month, how much will you have left to invest in the following months?

Effective use of cash is not easily possible inside your head if investments, loans and bank accounts are scattered all over the place.

Digitalisation makes it difficult to track wealth

With digitalisation, people’s personal wealth is becoming increasingly dispersed across more and more services. Many people have accounts at several banks. Loans may be held in a different bank from the main current account. You might have grocery store bonus account, investment services, expense sharing app, credit card, side business account, PayPal, betting site. Credits can be bought, for example, on Wolt.

I currently have 38 accounts in my personal asset tracking. It would be easy to come up with more.

Automatic monthly payments make money disappear without a notice. For example, housing association fees, electricity bills, gym memberships and insurance fees etc.

Even for one-off purchases, it can be difficult to get a grip on the size of the bill. A credit card payment of 100 € or 1000 € feels more or less the same at the checkout.

With the right tools, these modern-day challenges can be turned into profits:

- Multiple accounts are combined in a single view

- Regular expenses are programmed in advance

- Schedule large one-off purchases

App version 1: Account balances in spreadsheet

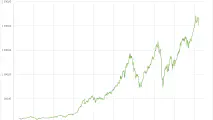

A few months after starting my first full-time job, I started recording my balances from cash accounts, loans and investments. This helped me to keep track of my overall financial situation.

There are an infinite number of apps in the world for monthly budgeting and tracking expenses. At no point did I feel it made sense to write down every single receipt.

What was interesting was the development of my overall wealth. In the business world, we would talk about balance sheets.

For personal use, the method is lightweight and flexible. A bit like logging every set in gym instead of recording just few test results each month. The performance trend provides enough information to evaluate the training program.

Balances could be recorded every day, every three years or however you like. Irregularity, missing balances or small deviations are not a problem.

The record does not have to be a bank account. Any asset category could have its own column in the spreadsheet:

- Value of a car

- Forest

- House

- A bonus account in a grocery store

I do not recommend recording accounts with the smallest balances.

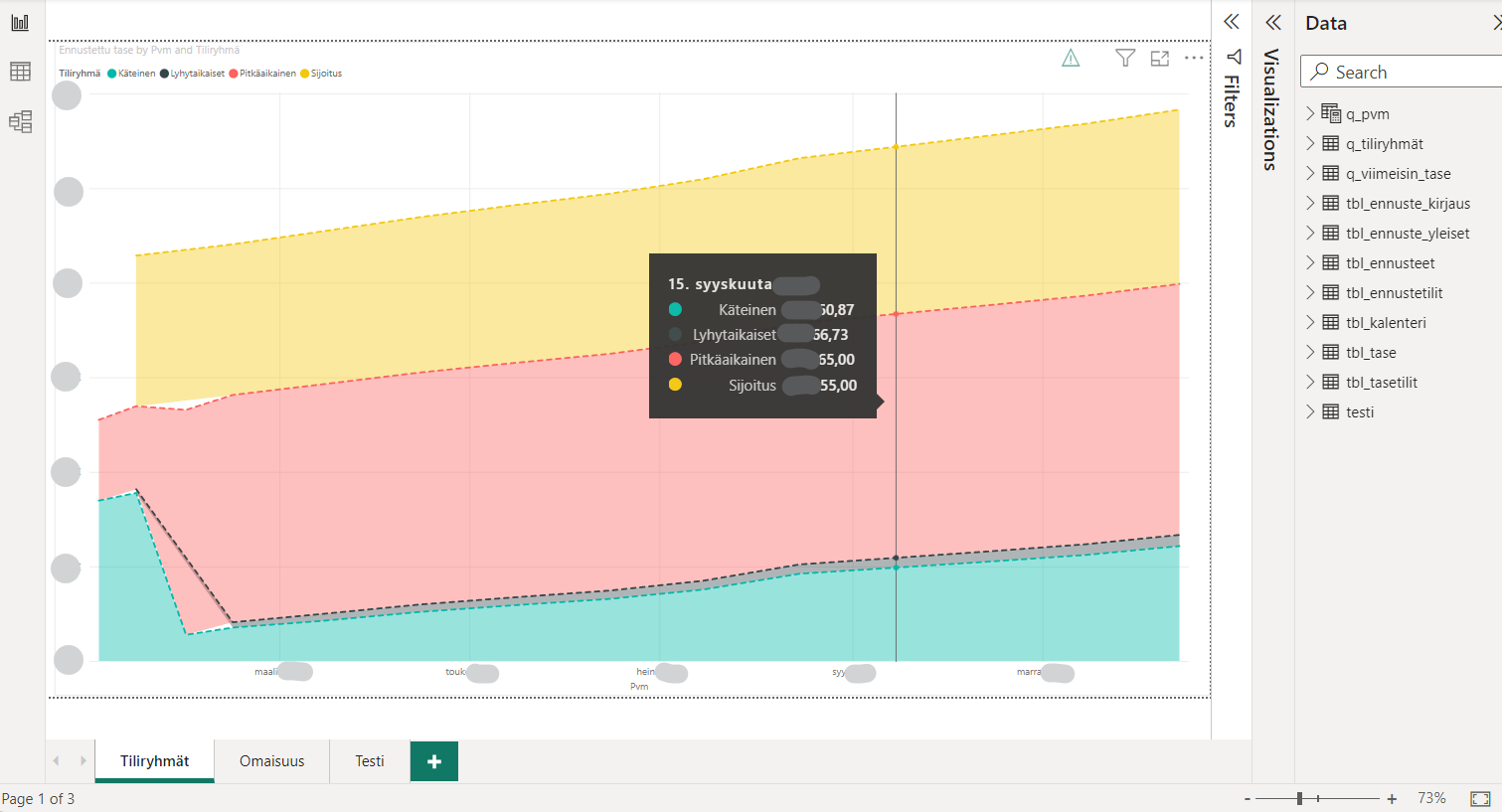

App version 2: Reporting tool for personal wealth monitoring

The spreadsheet started to have problems with the future projections. They required more visualizations, advanced data structures and a better user interface.

It was time to try a proper reporting tool to track personal wealth.

Transferring asset tracking to the reporting tool was relatively easy and quick. After some time, I found that even with this tool, the visualizations did not look as good as I had hoped.

App version 3: Off-the-shelf mobile app for wealth management

Personal Capital (now Empower) , Money Wiz and Wealthica seemed to be the most promising off-the-shelf systems for wealth management. But still no blockbuster.

Personal Capital, for example, was only for US and their eventual goal is to sell investment advisory services.

The most suitable options were aimed for professionals. Licensing costs were high.

Many wealth management applications were tightly integrated with banks and investment services. There are many ways to integrate and they do not always work as intended. Manually entering balances once a month ensured flexibility in my process and regular reflection on the financial situation.

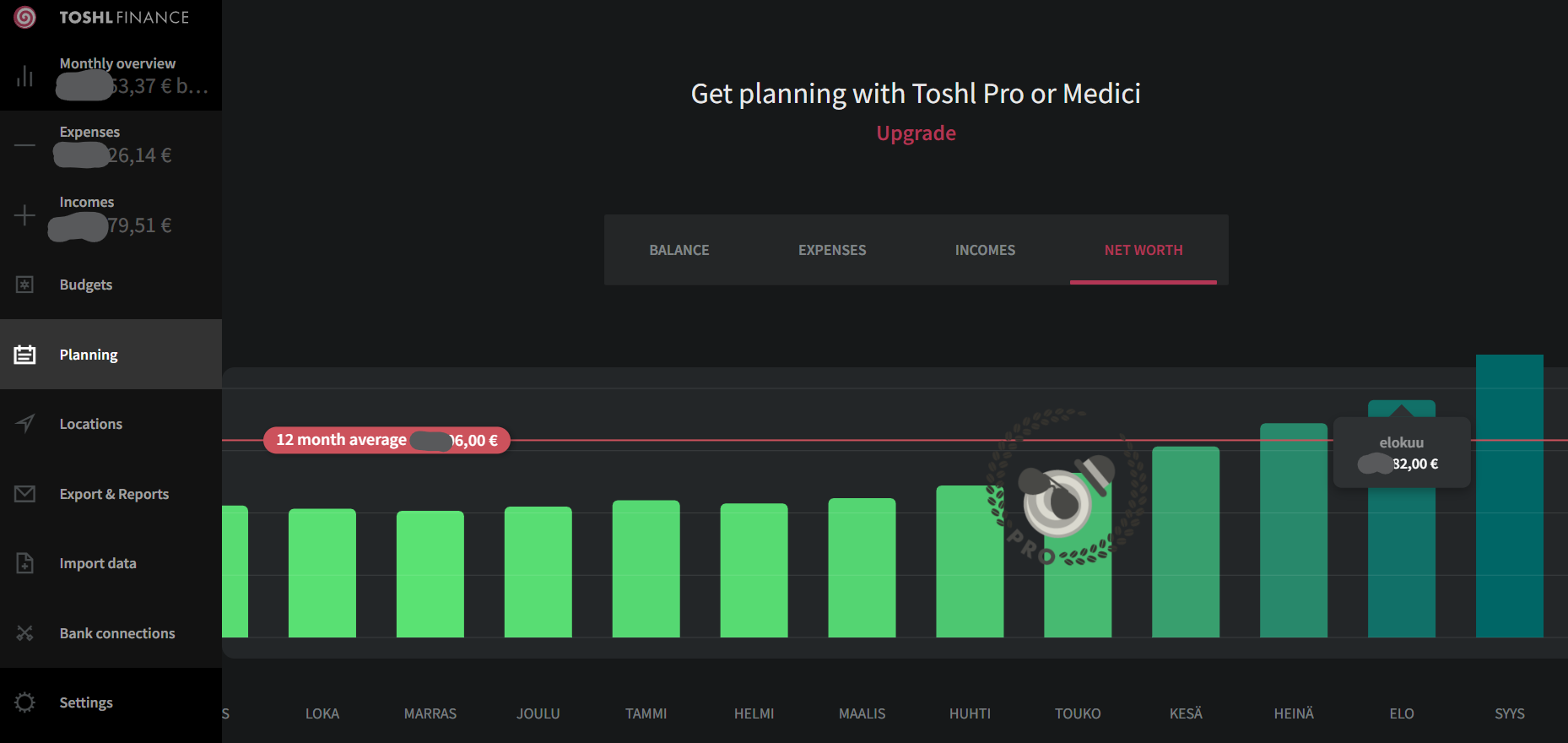

I ended up trying the Toshl application . It is not primarily intended for balance-based asset tracking, but with a little tweaking the application was able to accommodate this.

Toshl Pro cost $20 per year. The interface was neat and had flexible options for grouping and filtering data.

Eventually I became frustrated with the charts, which had obvious errors. The tool also didn’t have the predictions I needed.

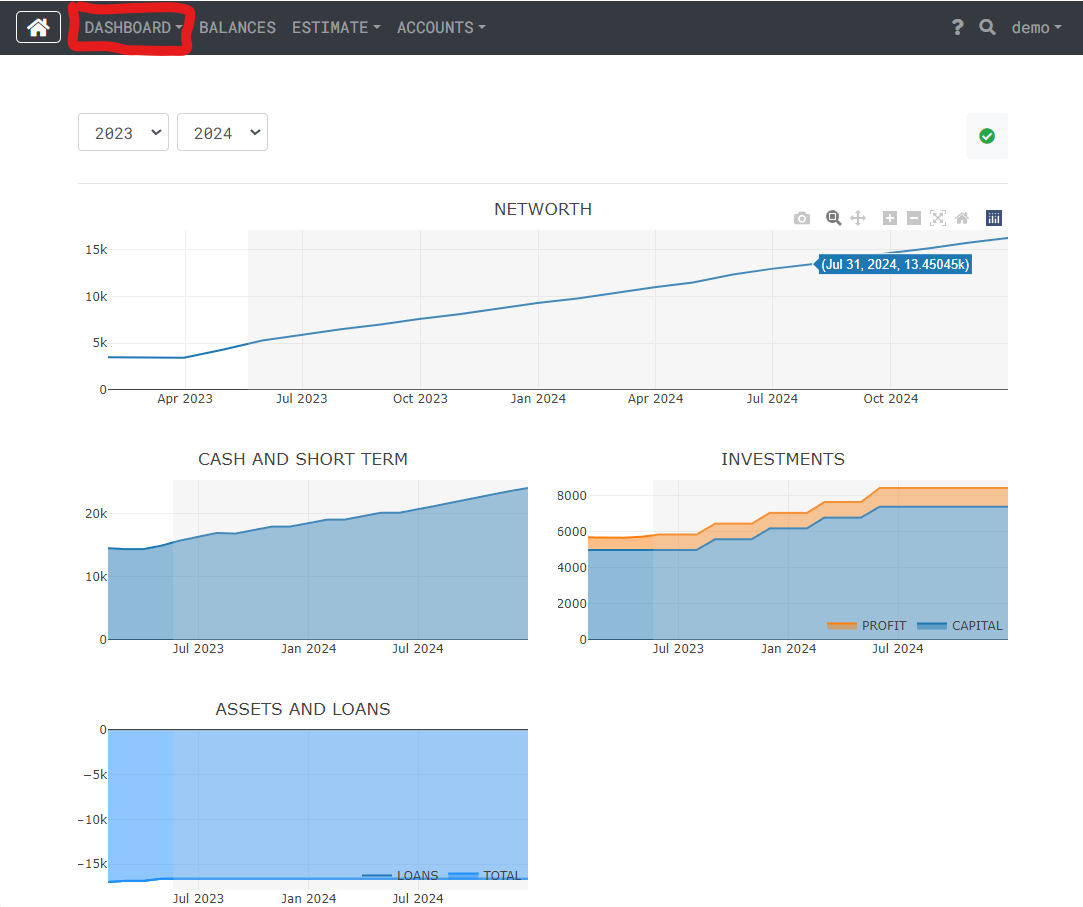

App version 4: My web application for wealth management

The Toshl mobile app had a data transfer interface from which I could extract the data into my own scripts. My intention was to create customized visualizations that were not readily available.

Slowly things started to fall into place, so to speak. Suddenly I had a web app running on my own computer, which made it easy to see the forecasts. As the interface evolved, Toshl became redundant.

Later, I moved my web application to the cloud. In practice, I can log in to my application by going to an address in my browser like app.example.com.

Here you find the wealth app technical description.

Wealth should not be maximized at the expense of quality of life

Wealth monitoring only takes into account things that have direct monetary value.

A holiday trip or a restaurant night out with friends will reduce wealth in the calculation model presented. So does a gym membership, even though it contributes to health and thus increases quality of life and probably wealth.

Wealth tracking does not take into account professional investments. An entrepreneur’s income may be moderate until after 10 years the business is sold at a big profit.

What is the value of nice neighbors or a short commute? Is it worth going to graduate school? Should I move abroad? What about having children?

I’ve tried some calculation models, especially for planning housing transactions. The end result has always been the same: the big decisions in life cannot be solved with calculation models.

But the problem is not the calculation model. It is as accurate as you want it to be.

Surprises such as the interest rate, corona virus, war and rising interest rates have in fact been taken into account in so-called “doomsday scenarios”. The problem is timing. You never know when the big wheel of the economy will break down and how long it will take to fix it.

Personal finance is just one part of life. My app helps with financial planning, just as Oura’s smart ring helps with understanding your health.

Money is not the same as quality of life. It is smart to accumulate wealth sustainably, but maximizing it can have irreversible negative effects.

Was it worth developing my own app for wealth management?

A lot of hours have been spent on the app. Albeit over several years. Today it works reliably without significant maintenance.

In the initial example, I had a student loan of 14 000 € lying in the bank account. Should I keep it in the account, pay it off, buy something with it or perhaps invest it? This simple question can have an impact of tens of thousands of euros over a lifetime.

Good financial decisions multiply. You can negotiate a better loan, buy more sustainable goods, make healthier decisions and so on.

In the price tag of risky financial decisions, the currency is not only euros but also personal well-being. Once you try to turn a big ship off course, a collision with an iceberg is inevitable.

Dare I say it, the wealth management app has already been worth the effort at this stage. It is the only data app I have developed that has remained in long-term use.

The future of the wealth management app

I have not made any changes to the application in the last six months. I will probably continue to develop it slowly according to my own interests.

The app supports multiple users, but there are no plans to commercialize the product.

If you are interested in talking more about this, send me a message .

Write a new comment

The name will be visible. Email will not be published. More about privacy.